"Indialand was born out of a dream: A dream to build India of the 21st century, a dream to create places which are in harmony with nature and yet provide the most modern comforts. We believe in creating landmarks for modern India through imagination, innovation and creativity."

Businessman Harish Fabiani is a Non-Resident Indian (NRI) who resides in Madrid. He completed his bachelor's degree in Electronics & Telecommunications Engineering from Delhi University in 1981 and his master's degree in Finance / General Corporate Management from Madrid IESE in 1988.

He is known as the pioneer of private equity financing in India. He has served as a strategic advisor to businesses on matters of corporate governance and transparency and is actively associated with technological companies, commercial real estate ventures, finance, and trade. Additionally, he was instrumental in arranging for José María Aznar, the former prime minister of Spain, to visit India in September 2008 with the goal of fostering positive interactions with politicians, businesspeople, and industrialists to fortify the political and economic bonds between the two countries.

Americorp Ventures, Fabiani's core business, is co-promoter and makes investments across a variety of industries. Over $2 billion in Fabiani family assets are held by the Madrid-based Americorp Group and are invested in public markets, private equity, and real estate in the EU and India. Since 1997, the organization has invested in Indian equities at an early stage. It is the driving force behind a number of prosperous brands in the Indian business community, including TV18, Nimbus, AsiaNet Satellite Communications, and Edelweiss Capital.

Furthermore, Fabiani co-owns India Land, a real estate development firm that specializes in commercial real estate in well-known Indian cities including Pune, Chennai, and Coimbatore. A 2.4 million square foot, LEED gold-rated IT park in Ambattur, Chennai, a 1.9 million square foot, LEED gold-rated IT SEZ in Saravanampathi, Coimbatore, and a 28-acre industrial park in Hinjewadi, Pune are among India Land's current projects.

Explore the diverse interests of Harish Fabiani, the esteemed Chairman of Indialand, a prominent figure in India's real estate and private equity landscape. A former squash enthusiast, Mr. Fabiani now embraces a variety of sports including Golf and Tennis, demonstrating his commitment to physical fitness and a healthy lifestyle. His routine extends to paddle tennis and regular gym sessions, underlining the importance of consistent exercise. Beyond sports, Mr. Fabiani's refined taste is evident in his art collection, boasting exquisite pieces from renowned artists across India and Europe. This unique blend of sports and art highlights Mr. Fabiani's multifaceted personality and his dedication to both physical well-being and cultural enrichment.

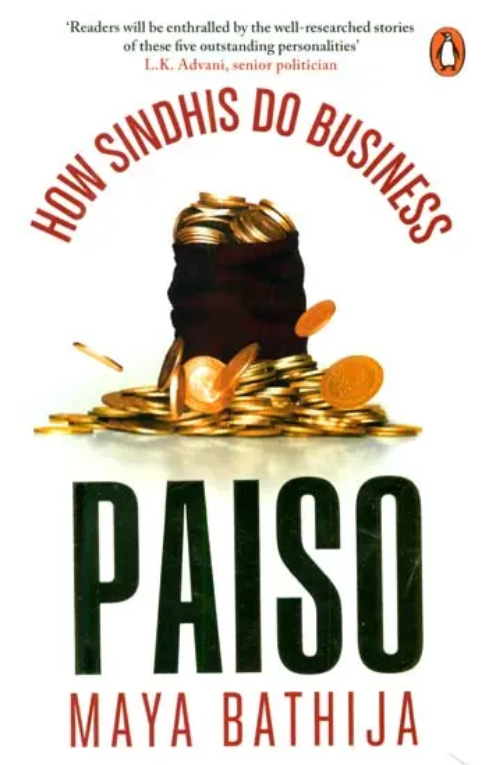

Guided by their sharp business acumen and adaptability, Sindhis have braved Partition, fled from one nation to another and weathered ups and downs in the economy to set up some of the biggest companies in the world. In Paiso, Maya Bathija, former head of content of the Sindhian, brings to you the extraordinary stories of five Sindhi families and the empires they have built over the years through Gary and David Harilela of the Hong Kong-based Harilela Group, renowned for their hotels; Ramola Motwani, chairwoman and CEO of the realestate investment and development company Merrimac Ventures; India's first individual angel investor and chairman of Americorp Ventures and India Land Properties, Harish Fabiani; Dilip Kumar V Lakhi, head of Lakhi Group-one of the biggest diamond suppliers in the country; and Jitu Virwani, real estate kingpin and CMD of the Embassy Group. Through the journeys of these incredibly successful companies, built painstakingly by many generations, this book takes a close look at the Sindhi way of doing business.

IndiaLand, a part of the AmeriCorp Group, showcases a distinguished portfolio boasting over seven million square feet of meticulously developed real estate. With a strong presence across various sectors including IT parks, IT SEZs, industrial parks, and commercial spaces, IndiaLand’s footprint resonates strongly in major Indian cities such as Chennai, Coimbatore, Pune, and Mumbai.

Pune is rapidly emerging as a dual hub for IT and real estate, driven by robust investments and strategic infrastructure improvements. The city's dynamic growth is attracting tech giants and property investors, setting the stage for a promising future in both sectors.

Read MoreThe Indian real estate market is booming. With rising economic growth and rapid urbanization, the market is estimated to reach a size of $1.3 trillion by 2034 and $5.17 trillion by 2047, according to a report by realtors body CREDAI.

Read MoreAs leading MNCs double their efforts to lure employees back to offices with better perks and hybrid models, the demand for sustainable office spaces is also rising.

Read MoreOver the last couple of years, India’s tier-II cities have recorded a swift increase in the sales of residential housing units. According to recent data by PropEquity, between 2023 and 2024 a total of 2,07,896 units housing units were sold in India’s top Tier-II cities, up from the 1,86,951 units sold in the preceding fiscal year.

Read MoreReal estate properties have been a go-to investment avenue for many and with the $40.71 billion Indian commercial real estate market undergoing rapid growth and development the sector is likely to remain in the limelight for years to come.

Read MorePolitical changes tend to influence India’s real estate market, especially if General Assembly elections prompt those changes. The phase leading up to the election and results is typically marked by heightened sentiments of fear and uncertainty stemming from concerns related to change in the ruling party, which could potentially prompt economic and regulatory changes.

Read MoreIn an era where technology underpins every facet of our lives, the commercial real estate sector stands at the brink of a revolution, driven by the dual forces of Artificial Intelligence (AI) and big data.

Read MoreReal estate investment trusts (REITs) and small and medium enterprise (SME) REITs stand out as particularly intriguing.

Read MoreIn the realm of commercial real estate, a profound and transformative shift is underway, heralding a new era where sustainability and eco-consciousness are at the forefront

Read MoreReal estate is undoubtedly one of the most crucial sectors in India, whose growth is indispensable for the health of the economy.

Read MoreIndiaLand group said that rapid development in infrastructure is attracting and settler in Tier-II cities.

Being a part of the real estate sector, we are anticipating favorable announcements and incentives from the upcoming Union Budget that will accelerate the sector's growth.

The end of the year 2022, also ended the work-from-home trend as we knew it. Most corporates started calling back their employees back to work-from-office. This led to a rise in office rentals...

In response to the union budget 2024, IndiaLand is energized by the government's clear focus on propelling the real estate sector into a nw grwoth era..